How to help closed-loop mobile payments get off the launch pad?

Despite the growing popularity of mobile payment apps like Apple Pay and Android Pay, over the past couple years, retail stores have been slow to adopt them.

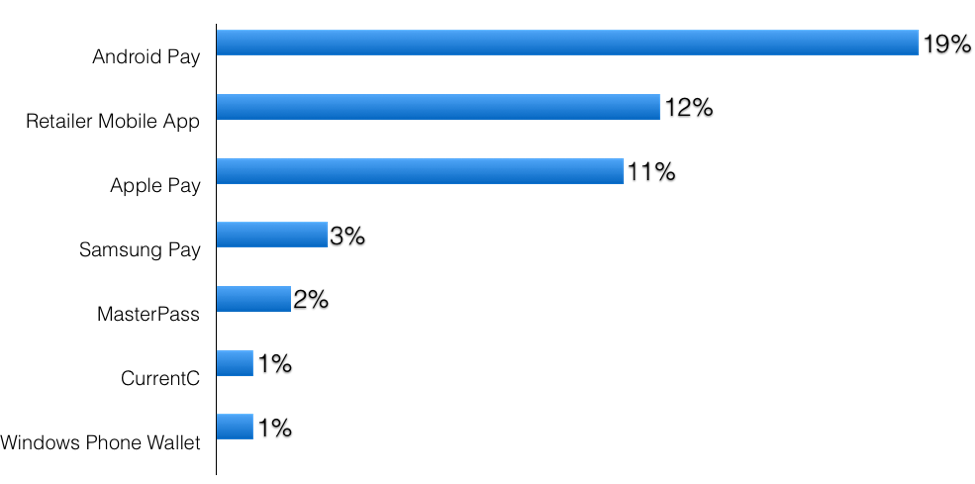

A little more than a third of consumers (36 percent) have used some form of mobile payment applications in the past year.

Source: Walker Sands Future of Retail Study 2016

Despite the lack of enthusiasm in embracing this technology, brick-and-mortar retail stores are trying to remove as much friction as possible from the payment process to eliminate consumer frustration and enhance the ‘buyer’s experience’.

To this end, retailers have adopted proprietary retail mobile apps that enable the customer to pay only in their stores (closed-loop payment).

Figure 1: Source: Walker Sands Future of Retail Study 2016

Stores are interested in creating a better in-store experience for both their brands and their customers, beyond payments. The key factor of that experience is: “all-in-one payment and reward.”

In-house proprietary payment (closed-loop) solutions have pros and cons. Some of the benefits of closed-loop payment systems are:

- Integrate payment, reward and receipt delivery into one transaction,

- Improve loyalty,

- Enable capturing big data on customers transactions, including customers buying habits, popular items, and even ROI measures on marketing campaigns,

- Minimize internal payment processing, which can lower merchant’s costs,

- Maintain ownership over the entire merchant/customer process.

Notwithstanding, using closed-loop payments also have several shortcomings:

- Customers can only use the system for purchasing and paying at the store (it cannot be used at other locations),

- Creates user fragmentation, affecting the adoption of the store app.

How stores are reducing the friction at checkout?

Currently, barcode is the technology mostly used to perform payment transactions at checkouts. Barcodes have been around for decades and have helped to integrate payments with the store’s loyalty programs. However, barcodes do not completely reduce friction because customers still need to:

- Pull up the app,

- Go to the barcode,

- Show the store associate the display to initiate payment,

- Associate will scan the barcode, and

- Only then can the transaction be completed.

NFC is the way to go

NFC is a more robust solution compared with barcodes, and definitely more secure.

Until recently, the acceptance of NFC-based smartphones has not been massive, thus preventing the use of NFC for this type of proprietary solution.

Apple launched the first version of NFC-enabled iPhone in 2014 (iPhone 6), however, NFC was not available for any other use, other than payments, until 2015 which saw the introduction of NFC-enabled passes. Meanwhile, Android had been supporting all-in-one payments and rewards for quite some time.

With the introduction of NFC-enabled passes on the iPhone, stores can now implement solutions such as ‘all-in-one payment and reward’ on iOS supported devices as well.

From the user’s perspective, using NFC closed-loop payments is faster and simpler. For example, using Apple Wallet, the shopper simply needs to hold the phone just above the card reader with a finger placed on the home button. It does not need to be connected to any network, nor does the shopper need to launch an app, key-in a password or manipulate the app in any way. The device does not even need to be unlocked.

NFC-enabled passes also simplify the distribution of reward cards; the reward passes can be downloaded from the Internet, sent by email, obtained from an app, etc.

Main drivers that will help accelerate the adoption of in-store NFC-enabled payments are:

- UX: Contactless transactions are more frictionless than their barcode counterparts.

- Integrated transactions: Stores want loyalty programs and payments transactions into one.

- Increases Throughput: NFC offers faster (at least 2x faster) and easier transactions.

– Daniel Baudino

Leave a Reply

Want to join the discussion?Feel free to contribute!